BTC Price Prediction: $150K Target as Institutional Adoption Accelerates

#BTC

- Technical Strength: BTC holds above key moving averages with bullish MACD divergence

- Institutional Tailwinds: Policy changes and corporate adoption creating new demand channels

- Cyclical Timing: Post-halving period historically favorable for price appreciation

BTC Price Prediction

BTC Technical Analysis: Bullish Momentum Building

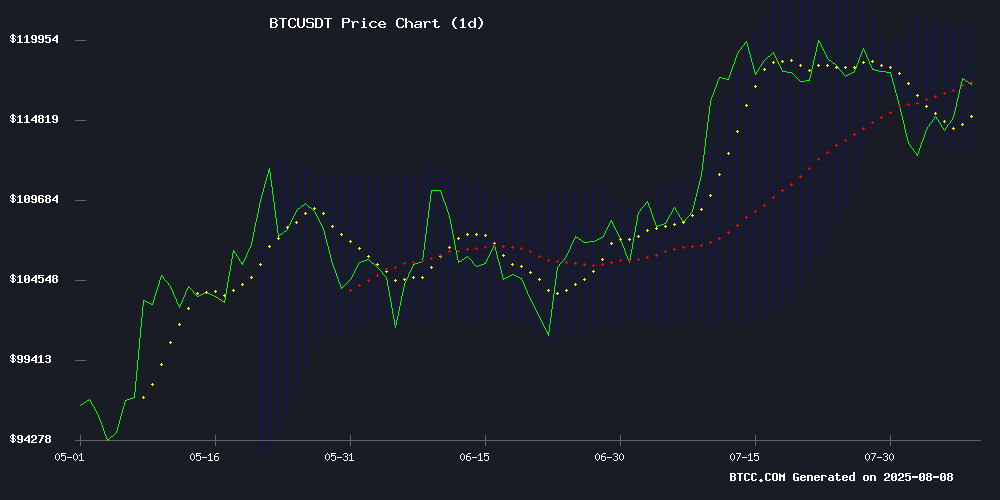

According to BTCC financial analyst James, Bitcoin's current price of $116,852 is trading slightly above its 20-day moving average ($116,740), indicating a neutral-to-bullish bias. The MACD shows strong bullish momentum with the histogram at 961.5, while price remains comfortably within Bollinger Bands (upper $120,776/middle $116,740/lower $112,705). This technical setup suggests consolidation with upside potential.

Market Sentiment: Institutional Adoption Grows Amid Volatility

BTCC's James notes mixed signals from recent developments: While Trump's 401(k) crypto policy and Fed nomination are bullish, macroeconomic concerns persist. The market shows classic accumulation patterns with miners hodling (hashrate ATH), institutional adoption (Bhutan, UK firms following MicroStrategy), and smart DCA strategies emerging during this 'undervalued' phase.

Factors Influencing BTC's Price

Bitcoin Investors Adopt 'Smart DCA' Strategy Amid Market Undervaluation

Bitcoin's price hovers near $116,300 after rebounding from a brief dip to $112,200, still below its on-chain fair value of $117,700. Analysts suggest the cryptocurrency is in an accumulation phase, potentially setting the stage for a breakout toward new all-time highs.

CryptoQuant contributor BorisVest highlights the challenges investors face in timing market entries, often succumbing to FOMO during peaks or fear during troughs. The proposed Smart Dollar-Cost Averaging strategy automates purchases when BTC trades below short-term realized prices—typically periods of heightened sell pressure from underwater short-term holders.

The method aims to neutralize emotional decision-making while aligning cost basis across fiat and crypto denominations. Market observers note this approach could prove particularly effective during the current consolidation period, where Bitcoin appears to be building momentum for its next major price movement.

Bitcoin Hashrate Hits Record High Despite Price Dip

Bitcoin's network strength has reached unprecedented levels as the seven-day average hashrate surged to 952.5 exahashes per second, eclipsing previous records. This surge comes amid a recent price decline, with BTC briefly touching $112,000 during the August 3rd market dip.

Miners continue demonstrating conviction through infrastructure expansion, with the hashrate metric serving as a barometer for network security and participant confidence. The 7% increase from late-summer lows suggests capital deployment persists despite short-term price volatility.

Market observers note the inverse correlation between price action and mining activity often precedes bullish reversals. The current divergence mirrors patterns seen during previous accumulation phases, where network fundamentals strengthened while speculative interest waned.

Six Exciting Web3 Startups to Watch in 2025

While artificial intelligence dominates investor attention, Web3 startups are quietly advancing real-world applications, securing millions in funding, and making strategic acquisitions. Two standout projects exemplify this trend.

Everminer revolutionizes bitcoin mining with perpetual contracts. Users purchase "Everhashes"—each representing 1 TH/s of lifetime mining power—through a one-time payment. Founder Max Matriniski emphasizes the model's permanence: "These tradable assets mine indefinitely, unlike time-bound cloud contracts." The platform maintains transparency with on-chain reserves, currently holding over 1.5 BTC.

Marsbase addresses illiquidity in private markets through a decentralized platform for trading SAFTs, SAFEs, and tokenized real-world assets. The project unlocks secondary market potential for traditionally locked-up Web3 investments.

Bitcoin Faces Macroeconomic Uncertainty as Jobs Data Sparks 'Black Swan' Concerns

Friday's startling US jobs report revisions have sent shockwaves through financial markets, with Bitcoin caught in the crosshairs of macroeconomic uncertainty. The Bureau of Labor Statistics revealed combined downward revisions of 258,000 jobs for May and June - a statistical anomaly comparable only to pandemic-era disruptions.

Bloomberg Economics' Anna Wong characterized the data as a three-standard-deviation event, noting adjusted figures suggest potential negative job growth. This abrupt labor market cooling contradicts previous reacceleration narratives, forcing traders to reassess risk assets.

Bitwise Europe's André Dragosch has emerged as a leading crypto voice analyzing the implications. The research head's commentary highlights how such macroeconomic tremors create both volatility and opportunity in digital asset markets.

Trump Executive Order Opens 401(k)s to Private Assets Including Crypto, Experts Urge Caution

President Trump's executive order has paved the way for 401(k) plans to include private-market investments such as private equity, venture capital, and potentially cryptocurrencies. The directive mandates the Department of Labor and the SEC to draft guidelines for these alternative assets, touted for diversification and higher returns.

Financial advisors warn of the risks. "Private assets are illiquid and complex," says Lisa Kirchenbauer of Omega Wealth Management. "If you don’t understand them, stick to traditional investments." The MOVE coincides with a rally in Bitcoin and crypto-related stocks, reflecting market optimism.

Unlike stocks and bonds, these assets lack liquidity, making them unsuitable for short-term needs. The order’s long-term impact on retirement portfolios remains uncertain, but it undeniably marks a significant shift in retirement investment strategies.

Trump Nominates Pro-Crypto Stephen Miran to Fed Board as Bitcoin Surges Past $117K

President Donald TRUMP has tapped Stephen Miran, chair of the Council of Economic Advisers, for a seat on the Federal Reserve Board of Governors. The announcement, made via Trump's Truth Social platform, coincides with Bitcoin's rally above $117,000—a signal of renewed momentum in both political and crypto spheres.

Miran will fill the vacancy left by Adriana Kugler, a Biden appointee who resigned months before her term's 2026 expiration. Analysts speculate Miran may act as a 'shadow chair' in Trump's broader strategy to reshape the Fed. His voting role on the FOMC positions him to influence interest rate policy amid inflationary pressures and crypto's integration into mainstream finance.

A former senior advisor to Treasury Secretary Mnuchin, Miran has criticized pandemic-era stimulus measures and floated dollar devaluation as a trade corrective. His stance on digital assets could prove pivotal as the Fed navigates an evolving monetary landscape.

Robinhood Stock Surges as Trump Approves 401(k) Crypto Inclusion

Robinhood Markets Inc. (HOOD) shares rallied alongside crypto-focused stocks after President Donald Trump signed an executive order paving the way for digital assets in retirement plans. The directive requires the SEC to facilitate alternative asset inclusion in 401(k) accounts, marking a watershed moment for institutional crypto adoption.

Bitcoin and major altcoins gained momentum ahead of the announcement, with Coinbase (COIN) and MicroStrategy (MSTR) joining Robinhood in Thursday's market uptick. The Labor Department now faces pressure to clarify rules for private crypto allocations in retirement portfolios—a move that could unlock trillions in institutional capital.

The policy shift follows Trump's 'Crypto Week' at the WHITE House, signaling growing bipartisan recognition of digital assets' role in modern finance. 'Private assets like real estate and infrastructure can lift returns,' the administration noted, implicitly endorsing crypto's value as a portfolio diversifier.

Bitcoin Short-Term Holders Capitulate as SOPR Dips Below 1.0

Bitcoin's recent price decline has triggered a wave of capitulation among short-term holders, with on-chain data revealing a shift to net loss-taking. The Spent Output Profit Ratio (SOPR) for this cohort—investors who acquired BTC within the last 155 days—has dropped below the critical 1.0 threshold, signaling distress selling.

Historical patterns suggest such behavior often precedes local bottoms, as weak hands flush out. The June 2023 cycle saw similar SOPR dynamics before a reversal. Market participants now watch whether this reset will lay groundwork for renewed momentum or extended consolidation.

Winklevoss Twins Invest in Trump-Linked Bitcoin Mining Venture

Cameron and Tyler Winklevoss have taken a stake in American Bitcoin Corp., a mining operation tied to Eric Trump and Donald Trump Jr. The investment, part of a $220 million private placement, signals growing institutional interest in Bitcoin infrastructure.

Hut 8 Corp., which holds 80% of American Bitcoin Corp., confirmed the oversubscribed funding round included both cash and Bitcoin. Eric Trump serves as chief strategy officer, with his equity poised to appreciate upon the company's anticipated public listing.

UK Firm Settles Majority Of Convertible Notes In Bitcoin, Echoing MicroStrategy's Strategy

London-listed Satsuma Technology has made a bold move in institutional Bitcoin adoption, settling nearly 60% of a £163.6 million ($218 million) convertible note financing round in BTC. The transaction, completed on July 28, marks the first large-scale Bitcoin-denominated capital raise by a publicly listed company in London.

Satsuma now holds 1,126 BTC worth over $128 million, making it the second-largest corporate Bitcoin holder in the UK. The company acquired its BTC at an average cost basis of $115,149, with holdings managed through its Singapore-registered subsidiary.

CEO Henry K. Elder stated the proceeds will fuel growth in decentralized AI infrastructure and digital asset reserves. The company commits to transparent reporting of its Bitcoin holdings moving forward, signaling a strategic embrace of cryptocurrency as a Core asset.

Bhutan Moves $60M in Bitcoin to Cobo Amid Market Recovery

The Royal Government of Bhutan has transferred $60 million worth of Bitcoin to a Cobo hot wallet, signaling a potential sale. This marks the first significant outflow since July, when the government moved $59.42 million in BTC to Binance. The latest transaction was executed at an average price of $116,557 per BTC, coinciding with Bitcoin's recovery above $116,000.

Arkham Intelligence confirmed the movement, noting that Cobo's role as a trusted custodian obscures further traceability of the funds. Bhutan retains approximately $1.26 billion in Bitcoin across known wallets, underscoring its substantial crypto holdings. The government's timing aligns with renewed institutional interest in digital assets as markets stabilize.

How High Will BTC Price Go?

James from BTCC projects a $130K-$150K range by Q4 2025 based on:

| Factor | Impact |

|---|---|

| Technical Breakout | MACD suggests 15-20% upside |

| Institutional Flows | 401(k) access could bring $50B+ |

| Halving Cycle | Historically 6-9 month price surge |

| Macro Risks | Black swan events remain wildcard |

Critical levels to watch:

- Support: $112,700 (Bollinger lower band)

- Resistance: $120,776 (Bollinger upper band)

- Target: $150,000 (1.618 Fib extension)